In commemorating the 9/11 attack, we all are now watching the ABC two days series "The Path to 9/11". Despite the movie seems to discriminate one particular group, I would like to bring up some issue relating to a fictional hedge fund play, called "The USD/CHF Bombing Hedge Fund". Hey, don't take it seriously there's no such thing called bombing hedge fund, unless it's real. Or, at least, the figures is real.

Hedge fund is a high-fee investment play in creating funds invested in other investment funds, so like funds in the funds. Other than just investing long in securities, the most common practice of hedge fund is short-selling forex via government securities or derivatives market.

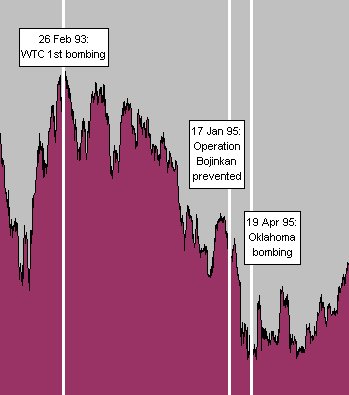

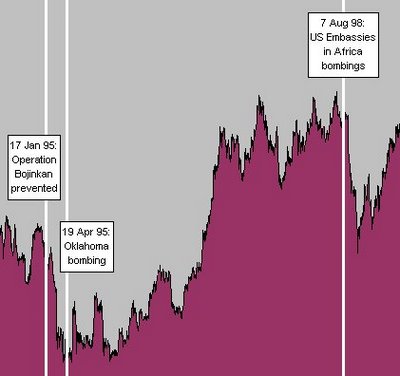

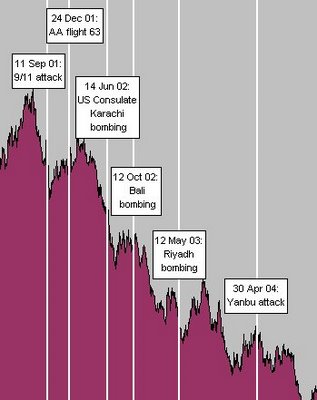

The play of this fictional hedge fund is to short-sell USD with CHF (SwissFranc) and buy it at any lower prices. Of course, after a set of bombing plots that can shake the USD down. For example:

- Borrow USD 1,000 Treasury Bonds then sell to Swiss counterpart at 1.70 receiving CHF 1,700.

- Wait and observe the market and news. The USD/CHF rate may drop because of a series of bombing plots.

- If it drops to 1.50, buy back the USD Treasury Bonds at that rate with CHF 1,500 receiving USD 1,000.

- Hey, we got CHF 200 profit (USD 133).

0 comments:

Post a Comment