This story began when I wrote about benchmark issue in CAPM. Then, it continued with an Excel model for optimisation of shares or funds portfolio. The main problem defined in the model is to select shares and find the optimised asset allocation in a portfolio with three scenarios:

1. Assumed CAPM can't be applied and historical data is important therefore historical mean (average) return and standard deviation are used to simulate random return normal distribution and calculate Variance Covariance matrix.

2. Assumed CAPM can't be applied and cumulative data is important therefore projected mean (average) return and standard deviation are used to simulate random return normal distribution and calculate Variance Covariance matrix.

3. Assume CAPM can be applied and cumulative data is important therefore projected CAPM return and standard deviation are used to simulate random return normal distribution and calculate Variance Covariance matrix.

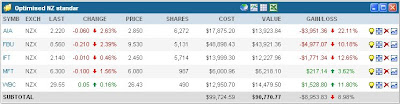

Starting by processing 13 NZ shares in the optimisation model with the three scenarios then applying the result of the share selection and the asset allocation into three passive portofolios, after one month holding period I found the return as follows:

Scenario 1 = -8.98%

Scenario 2 = -2.86%

Scenario 3 = +6.06%

I will update after 12 months.

CAPM return and cumulative data matter